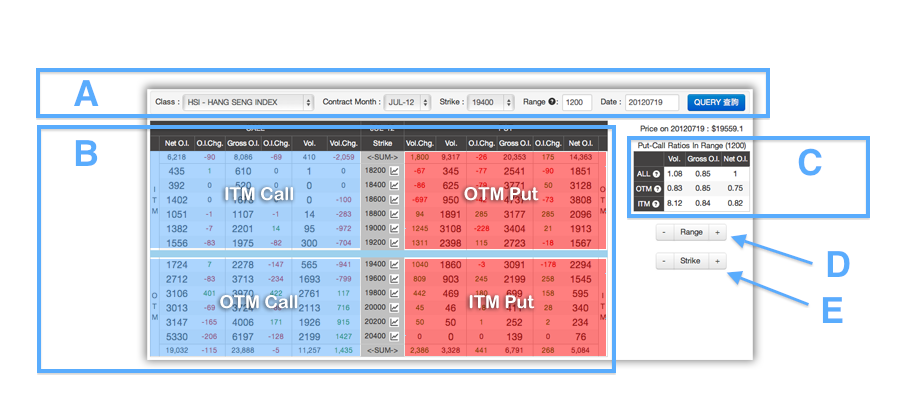

AZOPTION Range Analysis 近價期權分析

Range Analysis allows you to focus on a section of the option distribution.

A. Control Panel

B. Option Distribution

C. Put/Call Ratios

D. Range Control

E. Strike Control

A. Control Panel

- Option basic informations: Class, Contract Month, Strike Price.

- Range: Select the strike price range for the analysis.

- Date: Option data as of this date

B. Option Distribution in Range

- Left Hand Side (LHS): Call Options (Blue in color)

- Right Hand Side (RHS): Put Options (Red in color)

- Blue Horizontal Line in the middle: Current Underlying Price or Strike Price selected in (A) Control Panel

- LHS Upper Area: In-The-Money (ITM) Call Options (Blue in color)

- LHS Lower Area: Out-Of-The-Money (OTM) Call Options (Blue in color)

- RHS Upper Area: Out-Of-The-Money (OTM) Put Options (Red in color)

- RHS Lower Area: In-The-Money (ITM) Put Options (Red in color)

C. Put/Call Ratios In Range

Calculate the P/C Ratios with different combinations of option values:

Columns:

Columns:

- "Vol.": Put/Call Ratios of the Option Volumes.

- "Gross O.I.": Put/Call Ratios of the Option Gross O.I.

- "Net O.I.": Put/Call Ratios of the Option Net O.I.

- "ALL": All Puts / All Calls (i.e. RHS/LHS)

- "OTM": All OTM Puts / All OTM Calls (i.e. Right Upper Corner/ Left Lower Corner)

- "ITM": All ITM Puts / All ITM Calls (i.e. Right Lower Corner/ Left Lower Corner)

D. Range Control

+/- buttons allow you to increase or decrease the range size.

E. Strike Control

+/- buttons allow you to move the current underlying line (blue line) to the next or previous strike price.